The air at Chennai Port usually carries a symphony of sounds: the rhythmic clang of containers, the hum of forklifts, the distant cries of gulls.

But for an importer like M/s Wintrack Inc., the recent atmosphere was thick with a different kind of tension—the quiet hum of frustration, the rustle of unexplained paperwork, and the unsettling whispers of procedural irregularities.

Imagine the scene: a small team, hoping for swift and clean customs clearance, instead finding themselves navigating a labyrinth of delays, wondering if their consignment was caught in an unforeseen tangle or something more troubling.

It’s a moment that highlights a deeply human challenge: when the gears of commerce grind, it’s often trust that’s first to fray.

In a world striving for seamless, digital trade, the integrity of these critical checkpoints remains paramount.

Wintrack’s experience, unfortunately, wasn’t just a minor hiccup; it was a potent catalyst.

This single complaint ignited a full-fledged vigilance probe by the Central Board of Indirect Taxes and Customs (CBIC) into alleged irregularities at the Chennai Customs House.

It’s a stark reminder that even with advancements in technology and ease of doing business initiatives, the human element—and its potential for lapses—demands constant, unwavering scrutiny.

This isn’t just a regulatory action; it’s a critical test of India’s commitment to transparent trade administration and investor confidence, a commitment reaffirmed by CBIC’s official statements (CBIC, 2025).

The Central Board of Indirect Taxes and Customs (CBIC) has launched a comprehensive vigilance investigation into alleged irregularities at the Chennai Customs House.

This follows a complaint from M/s Wintrack Inc., prompting a preliminary enquiry by the Department of Revenue.

The probe has led to immediate transfers of implicated officers and suspension of a customs broker’s license, affirming CBIC’s commitment to transparent administration and trade integrity.

Unpacking the Procedural Lapses: Beyond the Surface

The core problem at Chennai Customs, as illuminated by Wintrack’s complaint, wasn’t about complex tariffs or shifting policies.

It was about fundamental procedural lapses and possible misconduct involving certain officials.

The Department of Revenue (DoR), tasked with a fair and transparent enquiry, submitted a preliminary report that pointed to these very issues.

This wasn’t merely a matter of inefficiency; it suggested a deeper erosion of the clear, standardized processes that are the bedrock of reliable customs operations.

What’s often overlooked is how a single, persistent complaint can pierce through layers of bureaucracy.

While grand policy statements make headlines, it’s often the diligent, often frustrating, efforts of an aggrieved party that finally force a re-evaluation of ground realities.

The Wintrack complaint stands as a testament to this, proving that vigilance isn’t just an internal function; it’s a symbiotic relationship between an accountable administration and an empowered, vigilant business community.

The Wintrack Catalyst: A Complaint Ignites Change

M/s Wintrack Inc. found itself navigating what it described as irregular practices and procedural deviations during its customs clearances at Chennai Port.

The company’s formal complaint wasn’t just a cry for help; it was a specific, actionable grievance that demanded attention.

This complaint became the genesis of the entire investigation, triggering the preliminary enquiry by the Department of Revenue.

The DoR’s subsequent report, acting on Wintrack’s allegations, confirmed patterns of irregular procedural conduct, providing the concrete basis for CBIC’s intervention.

This demonstrates a crucial insight for businesses: establishing clear, documented grievance channels and utilizing them effectively isn’t just a right, it’s a powerful mechanism for driving systemic change and ensuring accountability within the broader trade ecosystem.

CBIC’s Decisive Hand: Immediate Actions and Their Implications

Acting swiftly on the DoR’s findings, the CBIC has taken immediate and firm administrative actions, signalling a zero-tolerance approach to alleged misconduct.

This response isn’t just about addressing the Wintrack case; it’s about sending a clear message across the entire customs administration.

The research shows three key aspects of this response.

First, an investigation was triggered by verified allegations.

The CBIC has initiated a full-fledged vigilance investigation into alleged irregularities at Chennai Customs House (CBIC, 2025).

This probe aims to address alleged procedural lapses and potential misconduct within customs administration (CBIC, 2025).

The investigation directly follows a formal complaint by M/s Wintrack Inc. alleging irregular practices, and a preliminary enquiry by the Department of Revenue (DoR) confirmed findings that warranted deeper investigation (Department of Revenue preliminary enquiry report).

So-What: Even with digital reforms, the human element can introduce vulnerabilities, making robust internal controls and accessible external grievance mechanisms absolutely critical.

Practical Implication for AI Operations: Businesses should leverage AI for anomaly detection in their own large transactional data sets, identifying unusual patterns in clearance times, documentation requests, or payment flows that could signal internal or external irregularities.

Predictive analytics can flag potential bottlenecks before they escalate into formal complaints.

Second, immediate administrative actions were taken.

All officers named in the DoR report have been relieved of their responsibilities and transferred out of the jurisdiction with immediate effect (CBIC, 2025).

Furthermore, a Customs Broker Agent named in the report has had their license suspended under Regulation 16 of the Customs Brokers Licensing Regulations, 2018, pending final investigation results (CBIC, 2025).

These immediate administrative actions demonstrate a firm approach to malpractice and are intended to ensure the integrity of the ongoing probe (CBIC, 2025).

So-What: Swift, decisive action against proven or alleged misconduct is fundamental to restoring public and trade confidence.

It underscores that accountability is not just a theoretical concept.

Practical Implication for Business & Marketing: For businesses, this highlights the necessity of rigorous due diligence when selecting and monitoring third-party intermediaries.

For marketing, communicating a clear commitment to ethical practices, backed by demonstrable actions, can become a powerful brand differentiator, especially in markets where trust is paramount.

Third, the government has reaffirmed its commitment to integrity.

CBIC, through its official channels, has stated:

These measures reaffirm the government’s commitment to integrity and transparency in customs administration (CBIC, 2025, X post).

This approach is intended to restore trade confidence and signal deterrence against misconduct (CBIC, 2025).

So-What: This commitment sets a benchmark for all stakeholders, emphasizing that a clean, transparent environment is not merely aspirational but an active priority.

Practical Implication for AI & Operations: This commitment paves the way for greater adoption of transparent, auditable digital systems.

Businesses can develop internal AI-powered audit trails and compliance dashboards that not only track adherence to regulations but also proactively identify areas of potential risk, aligning their operations with the government’s push for integrity.

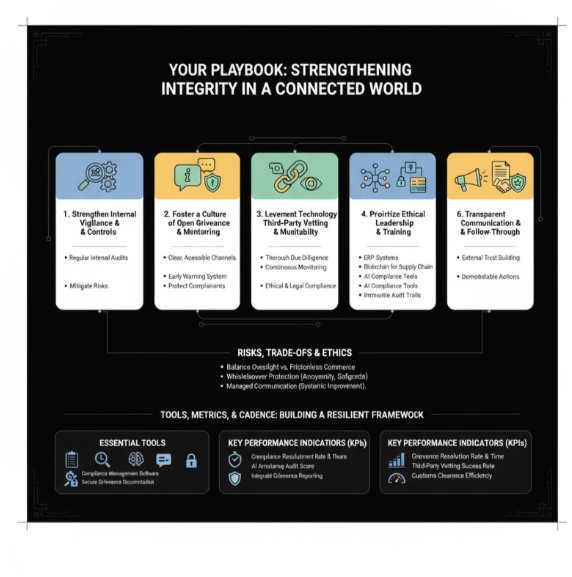

Your Playbook: Strengthening Integrity in a Connected World

The lessons from Chennai Customs extend far beyond its port.

For any business operating in complex regulatory environments, particularly those reliant on global supply chains, the imperative for integrity and transparency is non-negotiable.

Here’s a playbook for fortifying your own operations:

- Strengthen Internal Vigilance and Controls.Proactively identify and mitigate risks within your own organization.

This includes regular internal audits of all transactional processes, particularly those involving regulatory compliance or third-party interactions.

The very nature of the CBIC vigilance probe underlines the importance of internal checks and balances to prevent procedural lapses.

- Foster a Culture of Open Grievance Reporting.Learn from Wintrack’s example.

Establish clear, accessible, and protected channels for employees, partners, and customers to report irregularities.

An effective grievance mechanism is not just a compliance checkbox; it’s an early warning system.

Wintrack’s formal complaint was the catalyst for this investigation (Department of Revenue preliminary enquiry report).

- Implement Robust Third-Party Vetting & Monitoring.Your integrity is only as strong as your weakest link.

Given the suspension of a Customs Broker Agent (CBIC, 2025), a deep dive into your third-party relationships is crucial.

Conduct thorough due diligence before engaging any intermediaries, and implement continuous monitoring protocols to ensure their compliance with ethical standards and legal requirements.

- Leverage Technology for Transparency & Auditability.While the research doesn’t detail CBIC’s specific tech stack, the pursuit of transparency naturally aligns with digital solutions.

Implement enterprise resource planning (ERP) systems, blockchain for supply chain transparency, or AI-powered compliance tools to create immutable audit trails, automate checks, and identify anomalous data patterns that might suggest irregular practices.

- Prioritize Ethical Leadership and Training.Integrity starts at the top and permeates through regular training.

Ensure your leadership actively champions ethical conduct and that all employees understand their roles in maintaining compliance and reporting deviations.

This reinforces the firm approach to malpractice demonstrated by CBIC’s actions.

- Transparent Communication and Follow-Through.Align with the government’s commitment to public transparency (CBIC, 2025, X post).

Internally, communicate your ethical policies clearly and consistently.

Externally, be prepared to demonstrate your commitment to integrity, especially if navigating any inquiries or reviews, building trust with all stakeholders.

Risks, Trade-offs, and Ethics: Navigating the Nuances

While the pursuit of integrity is essential, it comes with its own set of risks and trade-offs.

Overzealous enforcement, for instance, could inadvertently slow down legitimate trade flows—a counterproductive outcome for an economy pushing for ease of doing business.

There’s a delicate balance to strike between rigorous oversight and frictionless commerce.

Ethically, the protection of whistleblowers and complainants is paramount.

If individuals or businesses fear retribution for raising grievances, the very systems designed to uncover irregularities will fail.

Mitigation strategies must therefore include strong safeguards for those who report concerns, ensuring their anonymity and protection from undue harassment.

Furthermore, the communication surrounding such probes needs to be carefully managed to maintain institutional credibility without premature condemnation.

The focus should remain on systemic improvements and accountability, not simply punitive measures.

Tools, Metrics, and Cadence: Building a Resilient Framework

To embed integrity as a foundational pillar, a structured approach is required, supported by the right tools, measurable metrics, and a consistent review cadence.

Essential Tools:

- Compliance Management Software are platforms that track regulatory adherence, policy updates, and internal audit schedules.

- AI-powered Anomaly Detection systems can analyze large volumes of transactional data (e.g., customs declarations, payment records, logistics timestamps) to flag unusual deviations from baseline operations, indicating potential procedural irregularities.

- Secure Grievance Reporting Systems are digital platforms that allow for anonymous or confidential reporting of concerns, ensuring that feedback reaches the right channels without fear of reprisal.

- Integrated Documentation Management solutions ensure all customs-related documentation is digitally stored, auditable, and immutable.

Key Performance Indicators (KPIs):

To measure the effectiveness of your integrity framework, consider tracking:

- Grievance Resolution Rate & Time, which is the percentage of reported concerns addressed and the average time taken for resolution.

- Compliance Audit Score, meaning regular scores from internal and external compliance audits.

- Third-Party Vetting Success Rate, the percentage of new vendors or partners successfully vetted against ethical and legal criteria.

- Customs Clearance Efficiency, which, while not solely an integrity metric, consistent, predictable clearance times can indicate well-functioning, transparent processes.

Review Cadence:

This could include

- Monthly internal compliance checks and reviews of AI anomaly reports.

- Quarterly comprehensive ethics and compliance committee meetings, including reviews of grievance data and third-party performance.

- Annually, company-wide ethics training, external audits, and a strategic review of the integrity framework in light of evolving regulatory landscapes and technological advancements.

FAQ: Understanding the Chennai Customs Probe

What prompted the CBIC vigilance probe at Chennai Customs?

The probe was initiated after a formal complaint by M/s Wintrack Inc. alleging irregular practices and procedural deviations, followed by a preliminary enquiry report from the Department of Revenue pointing to procedural lapses and possible misconduct (CBIC, 2025; Department of Revenue preliminary enquiry report).

What immediate actions has CBIC taken?

CBIC has relieved and transferred all officers named in the preliminary report and suspended the license of the named Customs Broker Agent (CBIC, 2025).

Glossary

- CBIC (Central Board of Indirect Taxes and Customs): The nodal national agency responsible for administering indirect taxes and customs duties in India.

- DoR (Department of Revenue): A department under the Ministry of Finance, Government of India, responsible for matters relating to all direct and indirect Union taxes.

- Customs Broker Agent: An individual or firm licensed to act as an agent for the transaction of any business relating to the entry or departure of conveyances or the import or export of goods at a customs station.

- Vigilance Probe: An official investigation undertaken to detect and prevent corruption or irregularities within an organization.

- Procedural Lapses: Failures to follow established rules, methods, or ways of doing something, especially those that lead to irregularities or misconduct.

The Road Ahead: A Promise of Purity

The saga unfolding at Chennai Customs is more than just a regulatory matter; it’s a living lesson in the enduring importance of integrity.

From a single complaint by M/s Wintrack Inc. to the swift actions of CBIC, this episode underscores that accountability is not merely an ideal, but a dynamic, active process.

The government’s pledge,

These measures reaffirm the government’s commitment to integrity and transparency in customs administration (CBIC, 2025, X post),

isn’t just a statement; it’s a promise to the businesses that fuel India’s growth—from the smallest MSME to the largest multinational.

As the vigilance probe progresses, its findings will undoubtedly influence how we think about trade facilitation, digital oversight, and the ethical foundations of commerce.

The ultimate outcome, however, rests on more than just investigative reports; it depends on a sustained commitment to fostering an environment where trust is paramount and ethical conduct is the norm.

Integrity isn’t just a policy; it’s the bedrock of a thriving ecosystem.

How are you fortifying your own trade integrity?

Let’s discuss.

References

- CBIC.(2025).

CBIC official statement on vigilance probe.

- CBIC.(2025).

CBIC official post on X regarding systemic measures.

- Department of Revenue.(Date Not Available).

Department of Revenue preliminary enquiry report.

“`

0 Comments