India’s iPhone Story: A Deep Dive into Shifting Desires

The aroma of freshly brewed chai hung heavy in the Bangalore air, mingling with excited chatter.

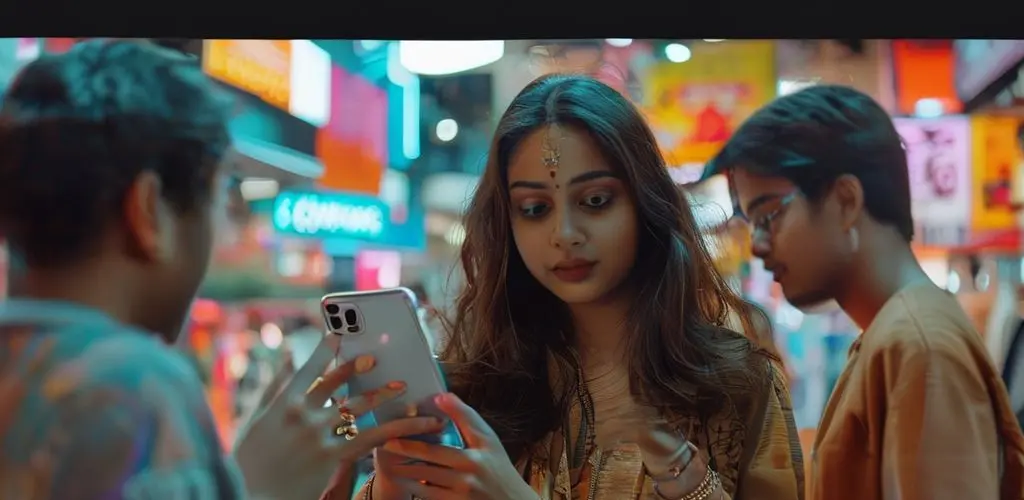

College students spilled from a newly opened tech store, a kaleidoscope of bright kurtis and modern denim.

Each group gravitated towards gleaming displays.

A young woman, barely twenty, held an iPhone – a sleek, silver device – with almost reverent grace.

Her friends leaned in, faces lit by its screen, discussing features, camera quality, and the quiet pride of ownership.

This wasn’t just a phone purchase; it felt like a significant moment, a clear marker of aspirations taking root.

In short: India’s evolving smartphone market shows a growing affinity for the iPhone, driven by diverse models, expanding retail, strategic pricing, and the powerful Apple ecosystem.

This shift reflects changing consumer preferences and positions India as a crucial strategic market for technology companies globally.

Why This Matters Now

This scene, playing out across India, speaks to a profound shift in consumer behavior and market dynamics.

For tech businesses, understanding this is paramount.

India, with its vast, digitally fluent population, offers fast-expanding opportunities for smartphone manufacturers.

It’s a market where brand perception, value proposition, and accessibility intertwine, shaping sales and broader digital lifestyles.

The growing presence of premium brands like Apple in a historically price-sensitive market signals a powerful transformation demanding global enterprise attention.

Understanding the Evolving Consumer Landscape

For years, India’s smartphone market saw aggressive price competition, dominated by Android brands.

The iPhone was often perceived as an out-of-reach luxury.

This narrative is subtly changing.

Indian consumers increasingly invest in devices offering long-term value, robust performance, and seamless digital ecosystem integration.

This signifies a move from purely transactional buying towards aspirational purchasing, where the device represents quality and status.

A key insight: premium brands can broaden appeal by maintaining aspirational status, rather than diluting it through excessive discounting.

The iPhone’s perceived value, durability, and ecosystem integration now resonate with a wider segment, turning a luxury item into a long-term investment.

The Story of Suman’s Upgrade

Consider Suman, a young professional from Hyderabad.

Her first smartphone was a budget Android, but as her career progressed, she battled performance and storage limits.

When upgrading, she prioritized longevity, software support, and seamless integration.

An iPhone, once beyond her budget, became compelling due to its ecosystem appeal and reliability.

For Suman, it wasn’t just upfront cost; it was peace of mind and enhanced productivity.

Decoding India’s Market Dynamics

The growing interest in Apple’s iPhone in India reflects a thoughtful, multi-pronged market penetration strategy, driven by deliberate actions and evolving consumer behaviors.

Diversified product offerings have played a significant role.

By providing iPhones at different price points—from flagships to value-oriented options—Apple has accessed multiple segments, ensuring the iPhone experience is available to a broader audience for deeper market penetration.

Expanded retail and distribution channels have significantly boosted availability.

Apple has increasingly partnered with local retailers and carriers, extending reach beyond major metros into smaller cities.

This strategic expansion improves access and reduces purchasing friction, critical for market growth.

Businesses must invest in robust logistics and strong local partnerships, blending online convenience with offline touchpoints.

Changing consumer preferences and brand loyalty are powerful drivers.

Many Indian buyers view the iPhone as part of a larger digital lifestyle.

Seamless integration with apps, services like Apple Music, and cross-device continuity creates a compelling ecosystem, fostering loyalty.

Emphasizing this holistic experience and long-term value is key for marketing, with AI-driven personalization deepening engagement.

A Playbook for Engaging Emerging Markets

Navigating markets like India requires a nuanced strategy.

Businesses should embrace tiered product strategies, offering a range from premium flagships to value-driven options for diverse economic segments.

Investing in localized retail and distribution is crucial, partnering with local carriers and retailers to expand physical presence in smaller towns.

Cultivating ecosystem value is paramount, selling a seamless digital experience where devices integrate with services and other products, fostering deep brand loyalty.

Prioritize strategic pricing and accessibility through local promotions, trade-in offers, and installment plans.

Amplify aspiration and social influence, recognizing premium brands can symbolize status.

Localize marketing narratives, tailoring brand stories to resonate with cultural values and aspirations.

Risks, Trade-offs, and Ethics

While growth opportunities abound, inherent risks exist.

Over-reliance on a single market segment or slow adaptation to evolving demands can stall momentum.

A trade-off involves balancing global brand identity with local market needs—can a premium brand remain aspirational while becoming more accessible?

Ethical considerations center on ensuring equitable access and responsible marketing.

Companies must prevent exacerbating digital divides or exploiting aspirational buying through predatory lending.

Mitigation involves transparent pricing, robust customer support, and investing in local communities, ensuring technology truly empowers.

Tools, Metrics, and Cadence

To capitalize on these market dynamics, a focused approach to tools and metrics is essential.

Key tools include Customer Relationship Management (CRM) platforms, Market Intelligence platforms, Retail Analytics software, and Digital Marketing and Analytics tools.

Key Performance Indicators are crucial.

Businesses should track market share, customer acquisition cost, customer lifetime value, retail foot traffic, conversion rates, ecosystem engagement, and brand perception scores.

Monitoring requires a structured cadence.

Weekly reviews cover sales and digital campaign performance.

Monthly assessments include acquisition costs, conversion rates, and competitor analysis.

Quarterly evaluations track market share, customer lifetime value, and shifts in brand perception or ecosystem engagement.

An annual strategic review encompasses market penetration and product lineup effectiveness.

Conclusion

The young woman in Bangalore, holding her new iPhone, wasn’t just making a purchase; she was stepping into a broader digital future.

Her device served as a gateway to productivity, creativity, and connection.

Her choice reflects a deeper trend in India: a growing confidence in technology, a willingness to invest in quality, and an aspiration for a seamless digital life.

For businesses navigating this vibrant landscape, the lesson is clear: authentic connection, strategic accessibility, and a deep understanding of evolving human desires will always be the most powerful tools.

India’s story isn’t just about sales figures; it’s about people embracing technology as an integral part of their dreams.

Are you ready to truly connect with them?